Forget about market volatility. Stake once. Earn every day.

Boost your crypto with Mevolaxyand earn daily rewards from MEV Bot activity.

based on mevstake Join Mevolaxy and earn with us.

What is Mevstake?

Objective comparison table.in network consensus.

in volatile tokens.

uses them to profit via MEV bots. Profit from extracting MEV via

arbitrage and sandwich attacks. High: up to triple-digit APY,

market-independent. No volatility risk when

using stablecoins.

How it works?

Watch the video to learn more.and freedom from market fluctuations. By analyzing transactions across multiple blockchain networks,

this method buys a coin just before significant price movement

and sells immediately after to maximize profits.

with strong security.

with trust.

| Time | Tx | Resources | Profit | Type |

|

|

||||

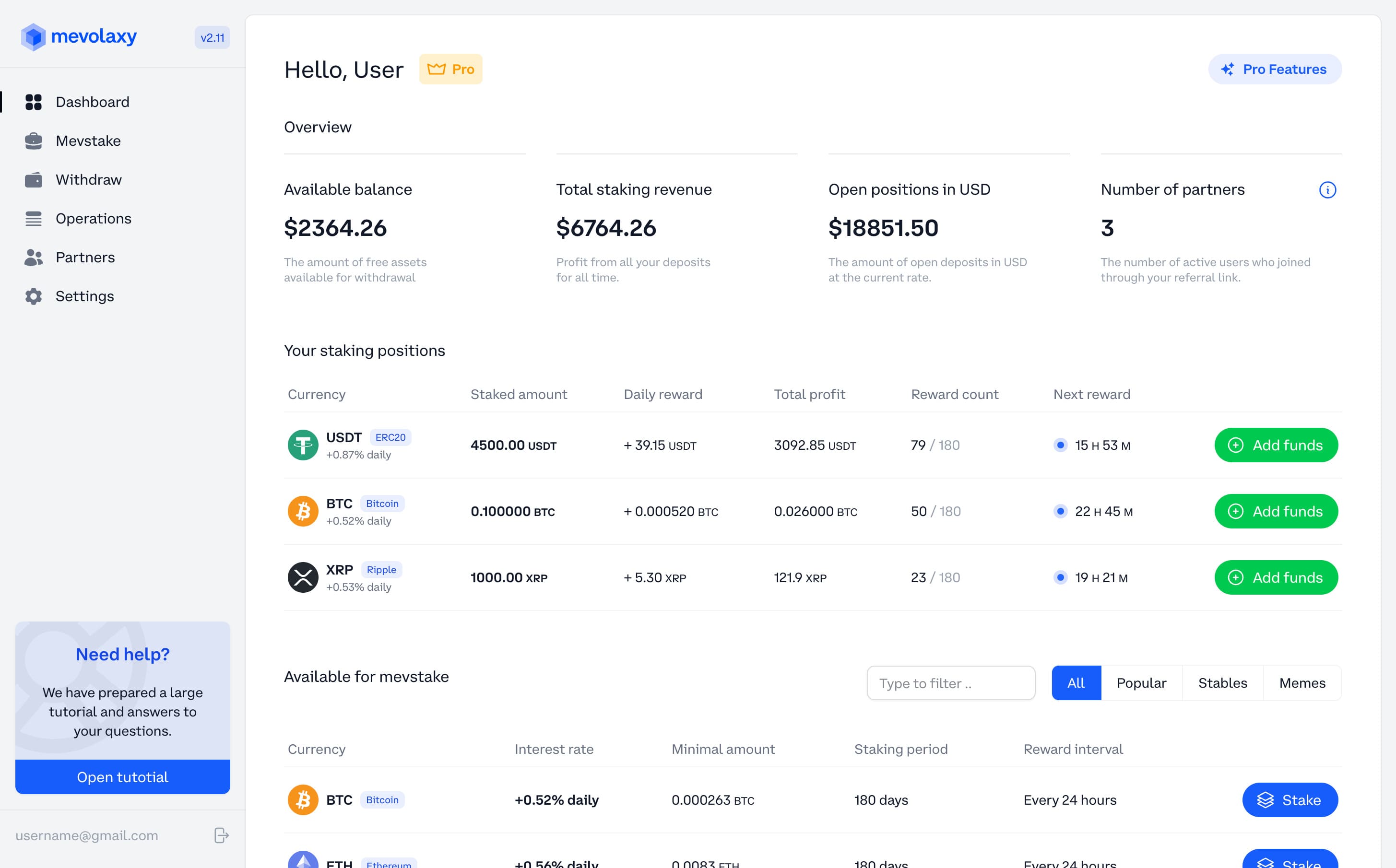

How to start?

Transparent and fair staking program is open to everyone.Our team

Introducing the key members of the team.Blog

The latest from Mevolaxy.

We continue to systematically expand Mevolaxy's international presence. As part of its global development strategy, the company has officially registered a new legal entity in Hong Kong.

Company No.: 79612395

BRC: 79612395-000-01-26-9

17F, 700 Nathan Road, Mong Kok

You can verify the accuracy of this information on the official Hong Kong Companies Registry website: https://www.e-services.cr.gov.hk/ICRIS3EP/system/dashboard/e-search.do

The past year has been one of the most dynamic and productive periods in Mevolaxy's history. We've grown in nearly every aspect: from infrastructure and revenue to our user base and global reach. The key figures below speak louder than words, showing just how much our ecosystem has evolved over the last 12 months.

Just one year ago, Mevolaxy was just gaining momentum. Today:

• 60,000+ active users worldwide

• Audience growth of more than 5x

• Strong community engagement and regular platform updates

Mevolaxy's core advantage remains its daily yield, which is driven not by market speculation but by on-chain network activity.

Over the year:

• TVL surpassed $50,000,000

• Investor payouts exceeded $2,500,000 monthly

• Yield is accrued daily via smart contracts, with withdrawals available at any time

• The system operates independently of market volatility, making Mevolaxy a "safe haven" during downturns

In the last 12 months, we have:

• Expanded our MEV bot network and refined their algorithms for Ethereum, BSC, Arbitrum, and other chains

• Completely redesigned our mempool scanning architecture

• Launched a dedicated department focused on user interface and user experience

• Opened API integrations for platforms and developers

• Launched the Mevolaxy app on the App Store

We actively participated in major global crypto events:

• Participation and a dedicated booth at TOKEN2049 Singapore.

• Strengthened media partnerships with TradingView, Bitcoin.com, CoinMarketCap, Investing.com, and Cointelegraph.

• Grew our teams in the US, Europe, and Asia.

The year culminated in a strategically vital event:

• Mevolaxy secured investment from the Helios Capital Research fund

• The investment totaled $4,000,000

• The fund named Mevolaxy "one of the most promising DeFi platforms for the next 3 years"

2025 was a year of massive growth for Mevolaxy. We fortified our foundation, continued to develop our product, and created the conditions for sustainable yield even during periods of market turbulence.

Most importantly - we are preparing an updated roadmap for 2026, which will include integration with new blockchains, expansion of MEV pools, UX improvements, enhanced API capabilities, and new products.

Thank you to everyone who stays with us and continues to earn with Mevolaxy. Your trust and engagement helps us grow and move forward, creating an ecosystem that grows stronger each month. 2025 was an important milestone. However, the main thing is yet to come, 2026, which we hope will be no less productive for both us and you. Thank you for being with us.